Charting the Global Economy: US Inflation Cools, Political Gridlock Grips France

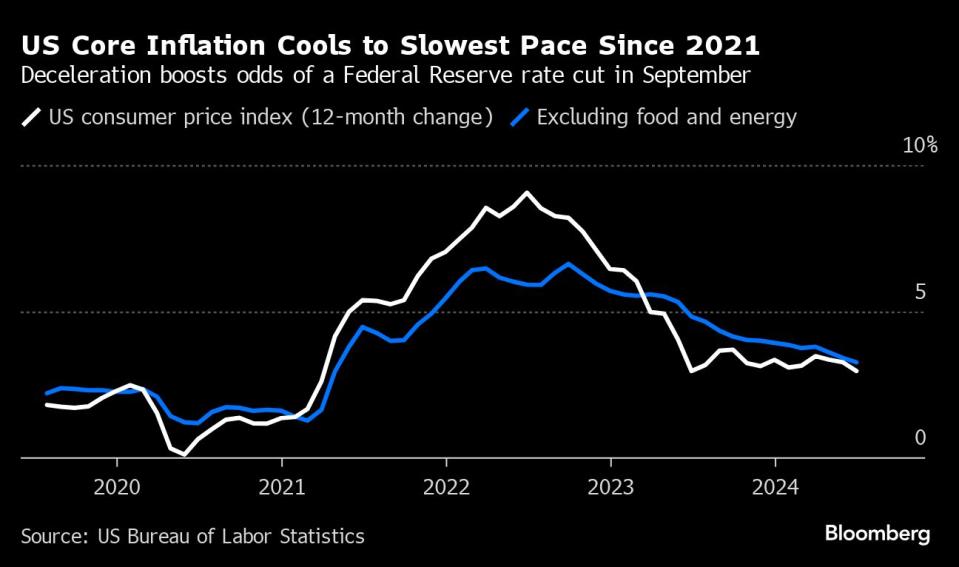

(Bloomberg) -- Underlying US inflation cooled in June to the slowest pace since 2021 on the back of a long-awaited slowdown in housing costs, sending the strongest signal yet that the Federal Reserve can soon cut interest rates.

Most Read from Bloomberg

BlackRock Says Gunman From Trump Rally Appeared in Firm’s Ad

Trump Emerges Defiant From Rally Attack Set to Shake Up ’24 Race

I Was at the Trump Rally Where He Was Shot. Here Is What I Saw

After the consumer price index report, Treasuries rallied and traders all but fully priced in September and December rate cuts. Policymakers will have a chance to signal such a move when they meet later in July, especially since the unemployment rate has now risen for three straight months.

Across the Atlantic, the left-wing parties that banded together to win the biggest number of seats in France’s snap election are struggling to unite to come up with a candidate for prime minister.

France has been plunged into political paralysis since the election on Sunday ended with the National Assembly split among three main factions after voters thwarted the far right’s bid to take power.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

The so-called core consumer price index — which excludes food and energy costs — climbed 0.1% from May, the smallest advance in three years. The overall measure fell for the first time since the onset of the pandemic, dragged down by cheaper gasoline.

Distressed investors see one of the best opportunities in a generation to buy troubled US real estate assets as the commercial property crash continues to roil the market. Almost $1 trillion of debt linked to commercial real estate will mature this year in the US, according to the Mortgage Bankers Association, and rising defaults as borrowers fail to repay will create more options for buyers of distressed assets.

Europe

Emmanuel Macron’s efforts to defuse the political crisis he created with a snap parliamentary election have elicited brusque pushback, underscoring the French president’s waning authority and highlighting deep divisions.

The political shock in France has forced bond investors to confront the reality that the nation’s fiscal deficit is an issue for here and now, not years down the road. The country has long benefited from investors dismissing the threat posed by its poor public finances given its core position within the euro area. That calm is now at risk.

Britain’s minimum wage increases are threatening to feed through to inflation and unintended consequences for employee benefits, putting Keir Starmer’s ambition to boost wages on a collision course with business groups and the Bank of England.

Asia

China’s trade surplus hit a record high of $99 billion in June as exports surged and imports unexpectedly declined, raising the risk of the US and Europe stepping up efforts to shield their markets from Beijing.

Japanese workers’ base salaries jumped the most since 1993, an encouraging sign that the underlying pay trend may start to support consumption and enable the Bank of Japan to raise interest rates again.

The boom in AI is driving a surge in Taiwanese exports, with the island’s companies shipping more than $42 billion worth of graphic processing units and related equipment over the past year, up from almost nothing in recent years. Those exports were worth $3.5 billion last month, up almost 422% from the same period a year ago.

Emerging Markets

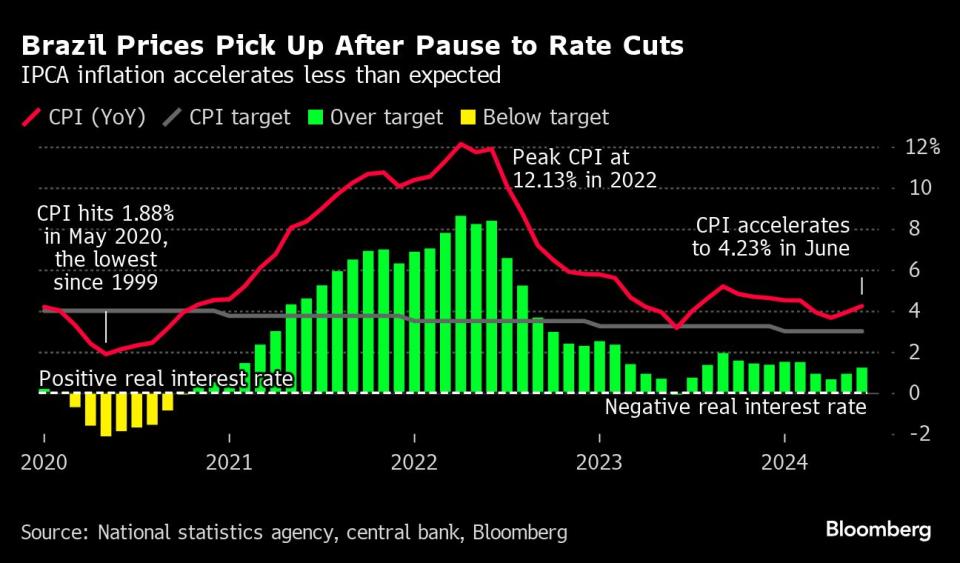

Brazil’s annual inflation rate rose less than expected in June as the central bank paused its cycle of interest-rate cuts to combat simmering price pressures. Policymakers broke a nearly yearlong streak of rate reductions last month as the economy outperforms expectations and investors fret over President Luiz Inacio Lula da Silva’s spending plans.

Mexico’s inflation accelerated more than expected in June, complicating the central bank’s efforts to cut interest rates that remain near an all-time high.

World

Israel’s central bank unveiled a new outlook that assumes the country faces a longer and more intense war, as it held interest rates for a fourth consecutive time. New Zealand kept rates unchanged for an eighth straight meeting, while central banks in Malaysia, Korea and Peru also held. Serbia and Kazakhstan reduced rates.

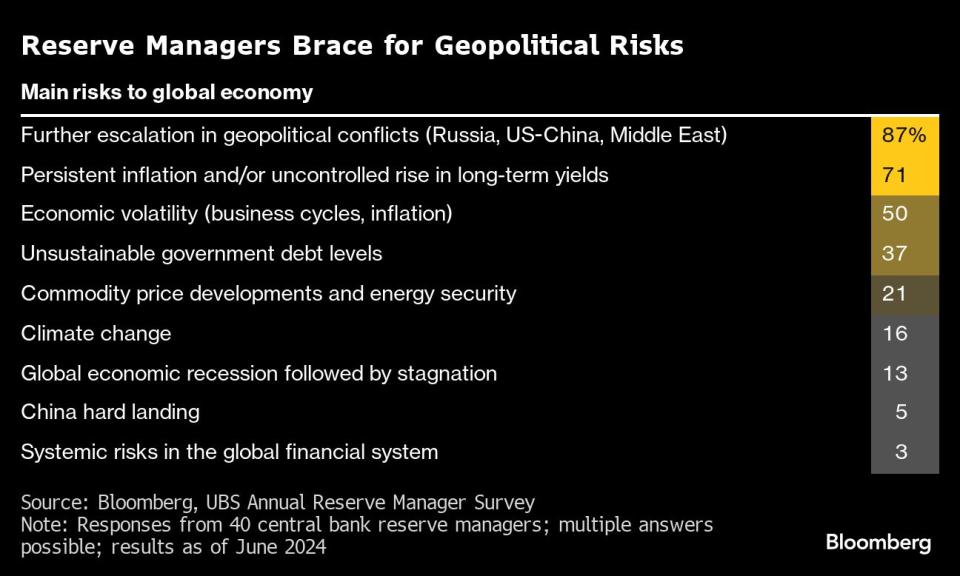

Central bank reserve managers are increasingly worried about the safety of their currency assets, citing rising geopolitical risk across the world, according to a UBS Group AG survey. The so-called “weaponization” of FX reserves was listed as a top risk by a third of the participants, double last year’s amount. The biggest concern is a further escalation in the tensions between Russia and Ukraine, China and the US, as well as the situation in the Middle East.

--With assistance from Samy Adghirni, Irina Anghel, Maya Averbuch, Valentine Baldassari, Neil Callanan, Alice Gledhill, Alan Katz, Yian Lee, James Mayger, James Regan, Andrew Rosati, Zoe Schneeweiss, Naomi Tajitsu, Keiko Ujikane and Erica Yokoyama.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.