Q1 Earnings Roundup: Dave & Buster's (NASDAQ:PLAY) And The Rest Of The Leisure Facilities Segment

Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at Dave & Buster's (NASDAQ:PLAY) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 13 leisure facilities stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 1.6%. while next quarter's revenue guidance was 5.2% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, but leisure facilities stocks have shown resilience, with share prices up 9.9% on average since the previous earnings results.

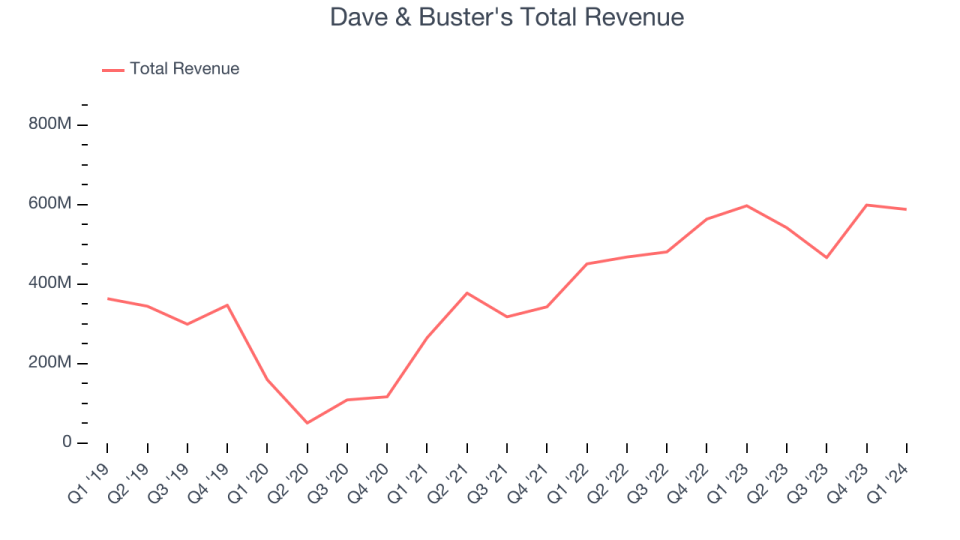

Weakest Q1: Dave & Buster's (NASDAQ:PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ:PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $588.1 million, down 1.5% year on year, falling short of analysts' expectations by 4.5%. Overall, it was a weak quarter for the company with a miss of analysts' earnings estimates.

"We continue to make material progress advancing our key organic growth initiatives. We have seen meaningful success growing our loyalty database through our new marketing engine, highlighting our enhanced food and beverage offering through compelling promotions, refining our games pricing strategy, driving incremental special events and clear outperformance in our remodel initiative which we expect will lead to substantial improvement in revenue and profitability over the medium term. We also continued to open new stores at highly attractive returns on our investment and have continued to opportunistically return capital to shareholders via our share repurchase program in a highly accretive manner” said Chris Morris, Dave & Buster's Chief Executive Officer.

Dave & Buster's delivered the weakest performance against analyst estimates of the whole group. The stock is down 27.3% since reporting and currently trades at $36.65.

Read our full report on Dave & Buster's here, it's free.

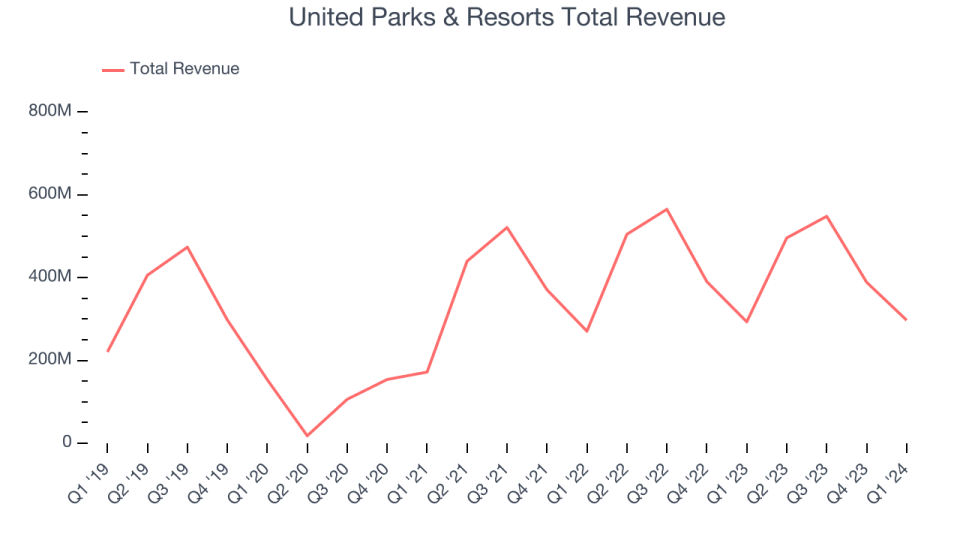

Best Q1: United Parks & Resorts (NYSE:PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

United Parks & Resorts reported revenues of $297.4 million, up 1.4% year on year, outperforming analysts' expectations by 4.5%. It was a very strong quarter for the company with an impressive beat of analysts' earnings estimates and a narrow beat of analysts' visitors estimates.

The market seems happy with the results as the stock is up 13% since reporting. It currently trades at $55.49.

Is now the time to buy United Parks & Resorts? Access our full analysis of the earnings results here, it's free.

Bowlero (NYSE:BOWL)

Operating over 300 locations globally, Bowlero (NYSE:BOWL) is a contemporary bowling company merging classic lanes with entertainment and deluxe food offerings.

Bowlero reported revenues of $337.7 million, up 7% year on year, falling short of analysts' expectations by 1.1%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

Interestingly, the stock is up 14% since the results and currently trades at $14.23.

Read our full analysis of Bowlero's results here.

Topgolf Callaway (NYSE:MODG)

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE:MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Topgolf Callaway reported revenues of $1.14 billion, down 2% year on year, falling short of analysts' expectations by 1.1%. Zooming out, it was an ok quarter for the company with an impressive beat of analysts' earnings estimates but full-year revenue guidance missing analysts' expectations.

Topgolf Callaway had the weakest full-year guidance update among its peers. The stock is down 10.6% since reporting and currently trades at $14.60.

Read our full, actionable report on Topgolf Callaway here, it's free.

Vail Resorts (NYSE:MTN)

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE:MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Vail Resorts reported revenues of $1.28 billion, up 3.6% year on year, falling short of analysts' expectations by 1.5%. Revenue aside, it was a weak quarter for the company with a miss of analysts' earnings estimates.

The stock is down 8.3% since reporting and currently trades at $178.

Read our full, actionable report on Vail Resorts here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.