In April, after Tesla’s year got off to a terrible start, Elon Musk made the argument to Wall Street that his car company shouldn’t be judged by its lackluster sales. Instead, he asked investors to buy into his wide-ranging sci-fi vision for the future, in which Tesla wouldn’t just be pumping out Cybertrucks and the like but running a global network of robotaxis that depend on his AI-like, self-driving technology. Wall Street loved it.

The pitch effectively lets Musk have it both ways. If sales suck, who cares? He’s building the future, dummy! If they’re great, even better! All the more drivers to feed his AI systems with. It’s the executive equivalent of playing three-card monte with investors, a game he is particularly adept at and one that Tesla shareholders seem to keep coming back to, clapping their hands and begging for more.

On Tuesday, Musk did it again. Tesla announced that its vehicle deliveries last quarter were down 4.8 percent from the same period in 2023, its second straight quarter of year-over-year decline. It also produced fewer cars and instead moved more of the excess inventory it had previously manufactured — a fine thing to do when your goal is lowering costs but a signal that broader demand is also weakening. The Wall Street response? Tesla’s stock went up about 9 percent. Yes, it was possible to see this as a big victory since deliveries were up 15 percent from the first quarter. But really, it was all about beating the rock-bottom expectations that Tesla itself had set.

It almost seemed as if Wall Street had ignored the sales figures altogether — and there is some reason to believe that’s true. The day before, Musk followed Travis Kalanick, the co-founder and former CEO of Uber, on X, which sent shares up more than 4 percent. The two had once discussed a robotaxi venture, and even though it didn’t go well, and even though Tesla didn’t mention self-driving or autonomous vehicles on its earnings call, Wall Street chose to interpret a potential Musk-Kalanick collab in a certain way. “The real story here for investors is on the technology front, with both the humanoid robot and the Robotaxi stories developing at an exciting pace,” Thomas Monteiro, a senior analyst at Investing.com, wrote in an investor note. “Both, particularly when combined, have the potential to become absolute game-changers for the company’s margins, leading to the type of sales Tesla shareholders expect.”

Sound familiar? Since 2014, Musk has predicted that autonomous cars were a year or so away. He has made outlandish promises about robotaxis, despite reported federal criminal investigations into his technology, and has floated the ability to summon cars with the touch of a phone, far before that technology was ready for broad use or even allowed on some roads. And then there are his assurances about hyperloops or life on Mars. There’s no doubt that Musk has bent reality to his will with the once-far-fetched successes of Tesla, SpaceX, and Starlink. That does not mean every one of his zany business ideas is nearly ready for prime time. But given the way Wall Street keeps lapping up Musk’s hype regardless of his follow-through, chances are he’s never going to change.

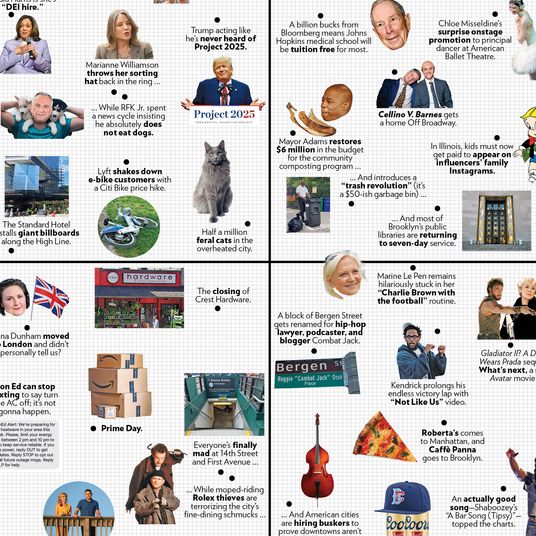

More From This Series

- Who Will Survive the ‘Zynpocalypse’?

- Inside the Harvard Business School Ponzi Scheme

- Jerome Powell Is Running Out of Reasons to Hold Interest Rates So High