I'm 35 and have never created a budget. (And I'm a personal finance writer 😬.)

After years of feeling like a fraud, I chatted with Ashley Russo, a wealth management advisor with Northwestern Mutual, who was kind enough to help me create my first budget.

1. Before we did anything, Russo made sure the setting and timing felt right. It turns out that making a budget can be emotional (just wait till you see how I reacted to No. 8).

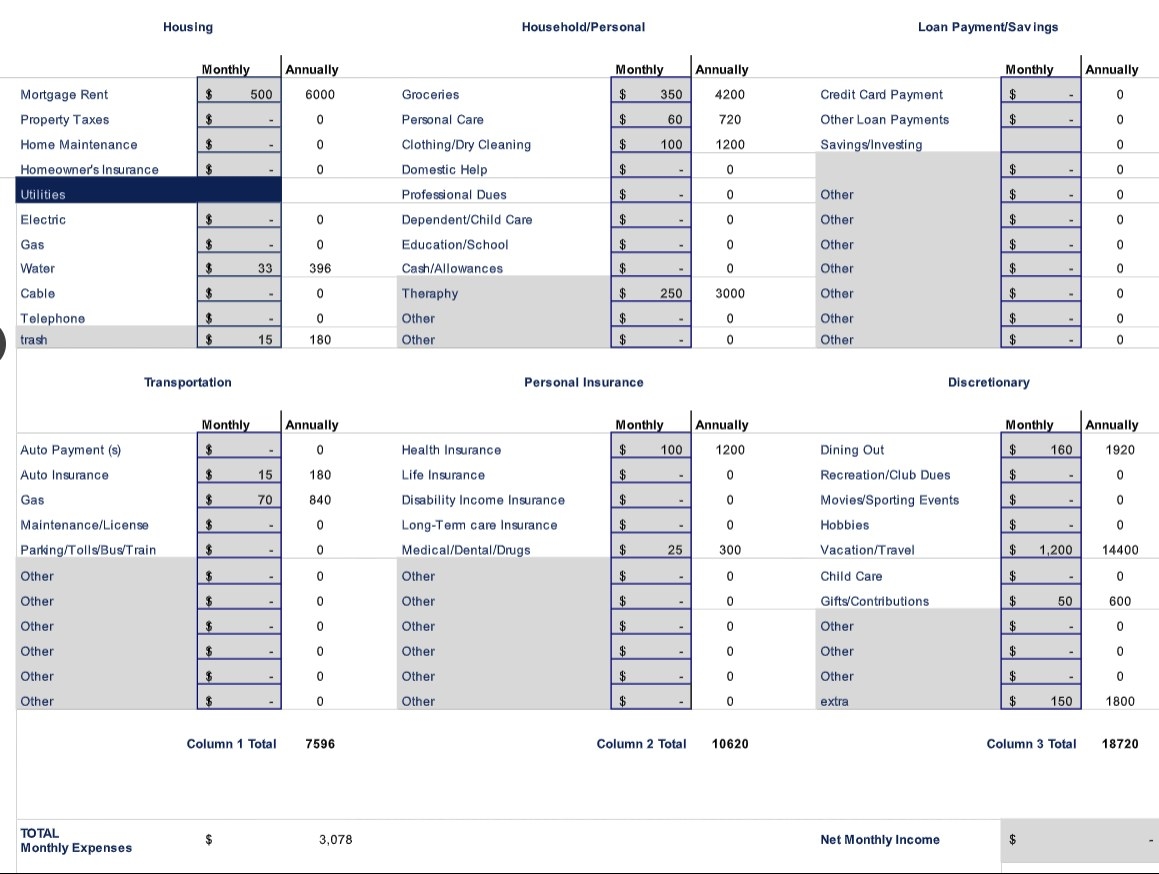

2. We used a budget template she had on hand (see below), but Microsoft Office has something similar, and there are a ton of templates online.

3. Budgets typically calculate your spending and earning in a month, but it may be easier to think of some expenses in terms of weeks or even years. (You can then convert to months for consistency.)

4. Russo had me start with fixed expenses — things like rent and utilities — which don't usually change from month to month.

5. Then we moved on to non-fixed expenses — things like groceries and dining — which aren't always super easy to determine.

6. Things like going to the movies, sporting events, and concerts are also considered non-fixed expenses. But keep in mind that you should only include them in the budget if you do them regularly.

7. This is where things can get complicated. If you regularly travel to see a band, you'll need to decide where to account for those costs — they could go with the money you spend on concert tickets OR under the travel section.

8. Russo noticed some emotion came up for me around clothing purchases (something I totally feel guilty about) and travel (which I spend a lot on).

9. If you have no clue how much you spend on certain non-fixed expenses, make a guess for now. Then, try paying for those non-fixed expenses on a separate credit card for a few months to get an idea of your spending habits.

10. There's a section in the budget to account for money you pay toward loans or credit card debt.

11. Then we moved on to savings.

12. Talking about savings opens up an entirely different conversation about money and retirement — a conversation that Russo recommends having with a financial advisor.

13. But before you get too far down the retirement rabbit hole, Russo says you should make sure you have a three- to six-month emergency fund.

14. And finally, at the end of your budget, add a line item for $100 to $150 to cover anything you missed or underestimated.

15. Then, add in your net monthly income to see how the flow of money IN compares to the flow of money OUT.

16. The idea is to keep your monthly expenses (including savings) equal to your monthly income. If you have a surplus or a shortage, you'll need to recalibrate things.

17. Your end goal should be to cover all your necessary expenses and either be saving toward an emergency fund or retirement. If there's anything left after that, it doesn't matter what you spend it on.

18. But with that being said, you also need to consider any long-term goals you want to work toward. For example, if I wanted to buy a house in a few years, Russo said I may need to cut my travel budget (and other areas).

19. Once you've created an initial budget, check in with it in three months. Then, make plans to update it every year.

Even thought it was emotional at times, creating a budget felt good — like checking something off a dusty to-do list. It also made me realize that I need to start thinking seriously about retirement.

How do you feel about budgeting? Tell us about it in the comments.

And for more stories about life and money, check out the rest of our personal finance posts.

Share This Article

Comments