Online checking accounts offer 24/7 accessibility and often lower costs and better interest rates than many traditional checking accounts. We’ve analyzed over 40 options to bring you the best online checking accounts with competitive rates, rewards and perks.

Best Online Checking Accounts in 2024: Our Picks

Below are our top picks for the best online checking accounts, many of which also make our list of the best free checking accounts and our overall list of the best checking accounts. Our research team reviewed checking accounts from more than 40 reputable online financial institutions, giving the highest scores to accounts that have no minimum opening deposit or monthly maintenance fee. These accounts also often provide perks such as cash back on debit purchases.

All providers on this list are insured by the Federal Deposit Insurance Corp. (FDIC) or the National Credit Union Administration (NCUA), which protects balances up to $250,000 per depositor, per bank. We’ll cover each account’s main features, pros, cons and account requirements.

After researching 114 banks and credit unions we at the MarketWatch Guides team rated these 6 as our picks for the best checking accounts.

- Discover Bank – APY not offered

- Varo Bank – APY not offered

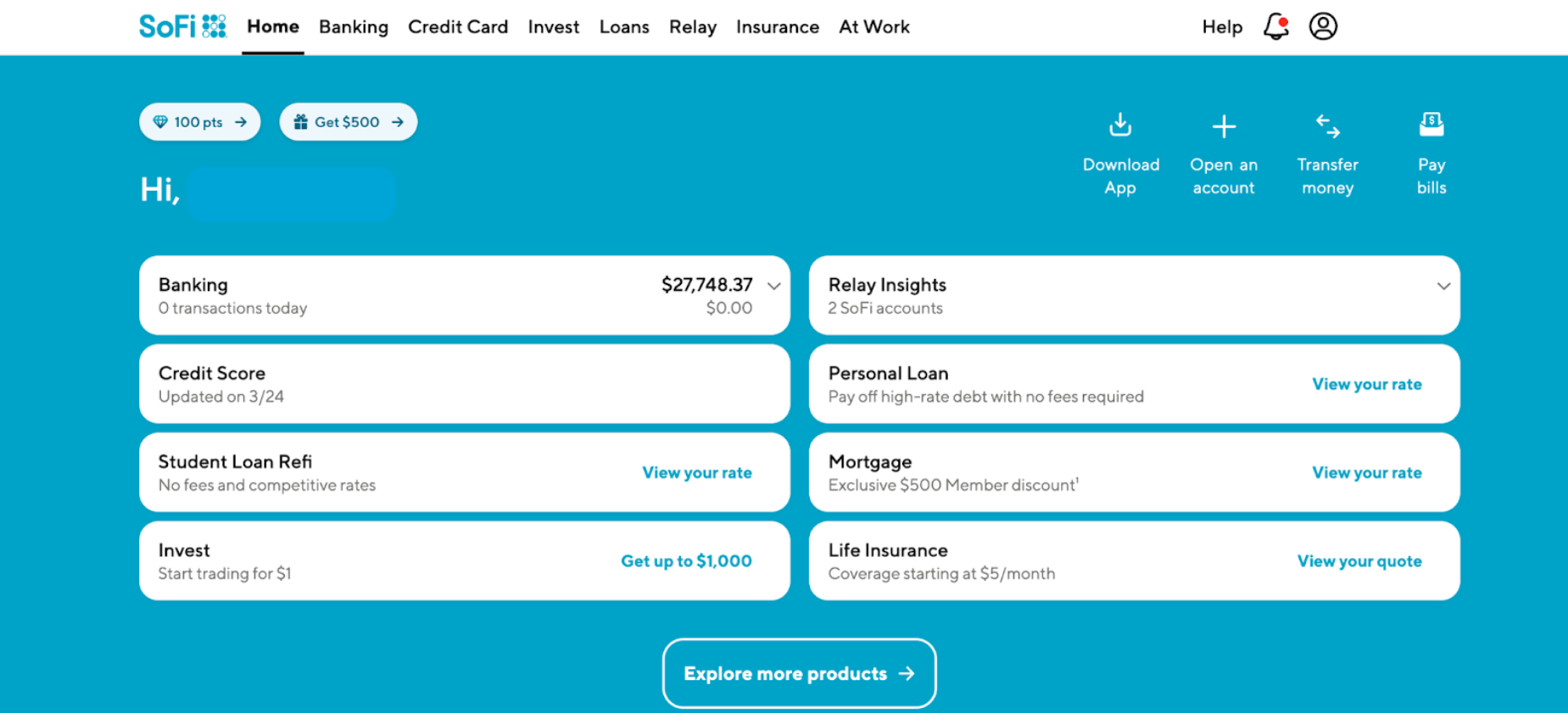

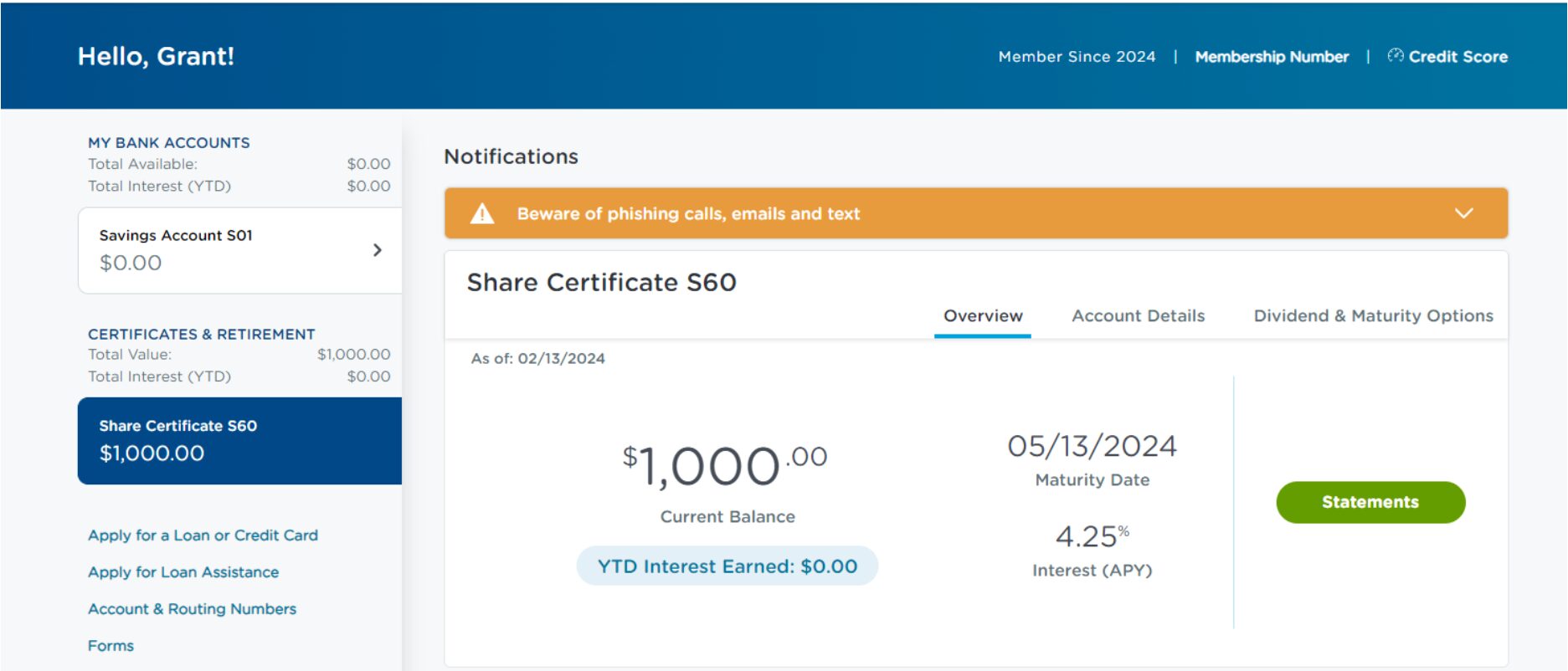

- SoFi – APY: 0.50%

- Ally Bank – APY: 0.10% or 0.15%

- Alliant Credit Union – APY: 0.25%

- LendingClub – APY: 0.10% or 0.15%

The Best Online Checking Accounts of August 2024

|

What Stands Out

One of the highest checking APYs available and a sign-on bonus with direct deposit

APY*

0.50%

Cash Back**

Up to 15%

|

|

What Stands Out

Up to $30 cash back per month on debit card purchases

APY*

N/A

Cash Back**

1%

|

|

What Stands Out

Up to $50 cash back per month on select brands with debit card purchases

APY*

N/A

Cash Back**

Up to 6%

|

|

What Stands Out

Spending buckets feature to help you budget and plan

APY*

Up to 0.25%

Cash Back**

N/A

|

|

What Stands Out

0.25% APY for standard and teen checking accounts with e-statements and qualifying monthly deposits

APY*

0.25%

Cash Back**

N/A

|

*APYs (Annual Percentage Yields) accurate as of July 17, 2024

** Cash back rates may vary based on provider terms and limits.

What To Look for in an Online Checking Account

Since banks and credit unions with online checking accounts don’t have the same overhead costs as their brick-and-mortar counterparts, some offer better perks and higher interest rates. Here’s what to look for to get the most out of your online account.

Online checking accounts offer a lot of convenience, but some features work differently than traditional brick-and-mortar banks. Before you choose one, make sure you review things like ATM access or other services that you intend to use.

Lower Fees

With an online bank, you usually won’t have to maintain a minimum balance to avoid paying a monthly maintenance fee as you might with a traditional bank. The best online banks also don’t charge overdraft fees or insufficient funds fees.

Since online banks tend to have large ATM networks, they also tend to have lower ATM fees. If you need to use an out-of-network ATM, some online financial institutions will reimburse you for some or all of those charges.

Higher Interest Rates

Traditional checking accounts don’t typically earn interest. If they do, the rate is often very low — the national average was 0.07% as of March 18. However, online banks and credit unions tend to offer higher interest rates for various types of accounts. In our consumer banking survey, about 55% of respondents said they would switch to an online bank for a better interest rate.

Mobile Apps

Mobile banking access is essential for many checking customers — 36% of our survey respondents consider a good mobile app or online banking experience one of the most important things about choosing a checking account. The best mobile banking apps allow you to transfer money (often via Zelle), deposit checks, find ATMs and make digital payments.

Some online financial institutions let you link outside accounts so you have a better idea of your finances. Some mobile banking apps also let you set up spending alerts and automated transfers.

Check Writing

If you still use paper checks (like 51% of our consumer banking survey respondents) choose an online checking account that has check-writing capabilities. Some accounts provide free checks.

Cash Deposits

Cash deposits with online checking accounts work differently than with brick-and-mortar banks. Some online banks and credit unions allow you to make cash deposits at select ATMs in their networks. With others, you’ll need to use a service such as Green Dot, which lets you deposit cash in your checking account at retailers such as CVS and Walmart. While some banks don’t charge fees for Green Dot deposits, others allow retailers to charge up to $4.95.

Early Direct Deposit

Many online checking accounts offer early direct deposit, a service that releases your direct deposits up to two days earlier than you’re scheduled to receive the money. If you want to access your paycheck early, choose an online checking account that offers this feature.

24/7 Accessibility

While there’s no in-person support, an online checking account can offer a lot of convenience and flexibility. You won’t have to worry about banking hours that don’t fit your schedule. You can usually make secure online transfers, use your debit card and visit ATMs at any time. Plus, online banks tend to offer 24/7 customer service options.

>> Related: Learn more about the best online banks

Consumer Insights: Our Checking Account Survey

In our consumer banking survey, we found that online financial institutions often provide the checking account features consumers care about the most. The most important feature for people selecting a checking account was low or no monthly fees (74% of respondents). Second was access to free ATMs (58%), and third was low or no overdraft fees (45%). Online checking accounts fit the bill on all three fronts.

Mobile and Online Banking vs. In-Person Banking

Roughly 75% of the people we surveyed prefer to bank via an online platform or a mobile app instead of visiting a bank branch. Here’s what a few of the people we surveyed had to say:

- “My bank makes online banking seamless and easy,” one respondent said.

- Another commented that “online services are just more convenient.”

- “I love how easy and convenient online banking is overall, not to mention the transactions seem to go through so much faster,” another person said.

The benefits of online banking that consumers in our survey mentioned included functionality, 24/7 access and not having to wait in line or rush to a branch. “My financial institution's digital platform's ease of use is more like playing a game,” one person explained. “I find it to be that easy.”

Generational Differences

According to our survey, younger generations are less likely to prefer in-person banking. Gen X is the generation least likely to bank in person, with roughly 81% preferring to bank online or with an app. Baby Boomers are the most likely to prefer in-person banking, but about 63% of them would rather access their accounts online or through an app.

Mobile App Performance

Our survey found that mobile apps are also important considerations for consumers who are looking for checking accounts. Overall, 41% of respondents prefer to bank via mobile app, and over 36% say a good mobile app is a top consideration when selecting a checking account. Roughly 44% of the people we surveyed use a mobile banking app daily.

Many customers said a bank’s mobile app would be a make-or-break feature, especially for depositing checks and transferring money. Some customers complained that their bank’s app was difficult to use and needed to be updated for increased speed. Others commented on how much they love their bank’s app.

“My financial institution has updated their mobile app and it is a way better experience for users,” one respondent said.

Recap of Our Picks for the Best Online Checking Accounts

- SoFi Bank Review: Best for Cash-Back Incentives

- Discover Bank: Best for Large ATM Network

- Varo Bank: Best for Mobile App Experience

- Ally Bank Review: Best for Customer Experience

- Alliant Credit Union Review: Best Online Credit Union Option

- LendingClub: Best for No Fees

FAQ: Online Checking Accounts

Based on our reviews, SoFi offers the best online checking account because it offers a sign-on bonus, a combined checking and savings account with competitive rates on all balances and up to 15% cash back on debit card purchases. However, the best option for you will depend on the banking services and features you need.

Yes, online checking accounts are safe when financial institutions take measures to prevent security breaches and you follow best practices for digital banking. Your money is also safe from a bank failure when you use an institution with insurance from the NCUA (for credit unions) or FDIC (for banks) insurance.

If your online account supports it, you can usually use your debit card to deposit cash at an ATM that accepts deposits. Some online accounts require you to visit a participating retailer instead. Note that you may have to pay a fee for each cash deposit.

Methodology

Our team researched more than 100 of the country’s largest and most prominent financial institutions, collecting information on each provider’s account options, fees, rates, terms and customer experience. We then scored each firm based on the data points and metrics that matter most to potential customers. Read our full methodology.

To find the best online checking accounts, our team reviewed checking account products from 40 reputable online financial institutions. The banks and credit unions that received the top ratings for checking accounts tend to have no minimum opening deposit, monthly maintenance fee and no or low overdraft fees, making them accessible to more customers. They often provide perks such as ATM reimbursements and cash back on debit card purchases.

- Savings and money market accounts (35% of total score): The best scores go to banks, loans and fintech companies with high interest rates and low or no fees or minimum opening deposits.

- Checking accounts (30% of total score): High marks are given to those with multiple accounts and minimal fees, plus benefits such as reward programs and mobile check deposit.

- Certificates of deposit (20% of total score): Top-rated financial institutions have low or no minimum opening deposits, as well as a variety of term options and specialty CDs for flexibility.

- Banking experience and access (15% of total score): Providers that excel in this category have large branch and ATM networks and multiple checking and savings accounts, and they earn more points for offering CDs and money market accounts.

*Data accurate at time of publication

**Rates and promotions accurate as of July 17, 2024

Editor’s Note: Before making significant financial decisions, consider reviewing your options with someone you trust, such as a financial adviser, credit counselor or financial professional, since every person’s situation and needs are different.

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides.