HOW TO GIVE

“Give us hope. Take the credit!”

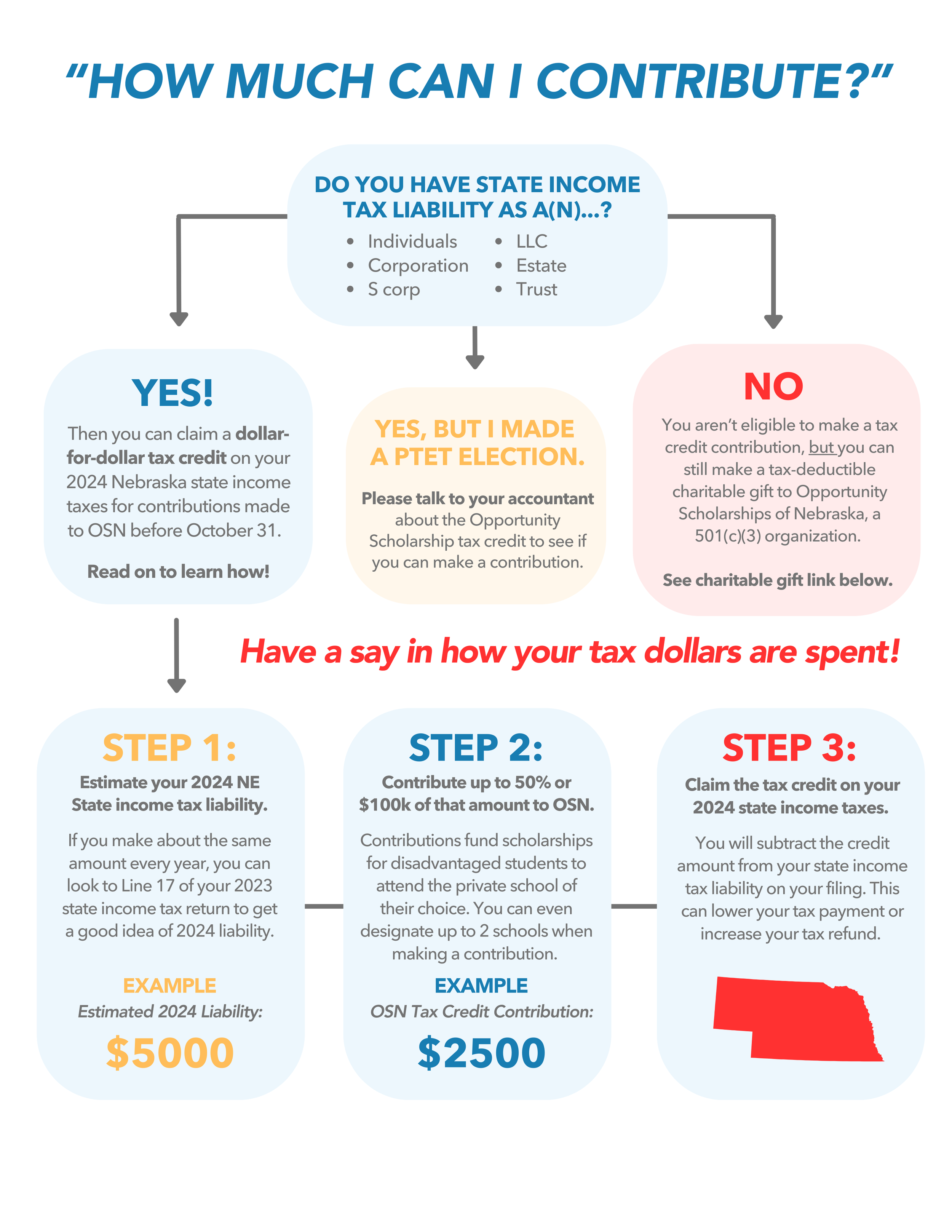

A tax credit contribution or tax deductible charitable donation to Opportunity Scholarships of Nebraska empowers families to choose the best option for their children, regardless of income or zip code. You can help create a brighter future for Nebraska’s students through the Opportunity Scholarships Act tax credit program or with a tax deductible charitable donation at any time.

MAKE A TAX CREDIT CONTRIBUTION

Nebraska taxpayers who want to support students in need of financial assistant to attend a school that works best for them are now offered a dollar-for-dollar tax credit for contributions to Opportunity Scholarships of Nebraska (OSN)! Contributions made in 2024 can be claimed on your 2024 state income taxes.

Both individual and corporate taxpayers are eligible to claim a dollar-for-dollar tax credit contribution, up to 50% or $100,000, of their state income tax liability. Here’s how it works:

NEW: COMPLETE YOUR FORM AND SUBMIT PAYMENT ONLINE.

OR

Fill out the NSGO-IC form (download here). Note: OSN will complete the signature section of the form.

Email or mail the completed NSGO-IC form back to OSN. You can return a .pdf, .jpg, or hard copy of the form. Email to givehope@nebraskaopportunity.org or mail to 5100 Van Dorn St. #6778, Lincoln, NE 68506.

OSN will submit your form to the Department of Revenue. When the Department of Revenue approves, OSN will contact you to make your contribution.

Submit your contribution to OSN and give hope to kids!

If you would like assistance with this process, please contact us at givehope@nebraskaopportunity.org or call 402.205.7047. For all personal financial questions, please consult your tax professional.

Sign up here to receive communication from OSN, including how your gift is giving hope to Nebraska families.

See the tax credit contribution process above for more information.

SSe

GIVE HOPE TO NEBRASKA KIDS TODAY!

Want to make a tax-deductible charitable gift?

OSN is a 501(c)(3) nonprofit organization, so you can give a tax-deductible charitable donation to OSN at any time without limit to help us get off the ground running and educate Nebraska families and students about the new scholarship program.

Opportunity Scholarships of Nebraska has been recognized as exempt from income tax under Section 501(c)(3) of the Internal Revenue Code. You should consult your personal tax advisor about the deductibility of your contribution and your record keeping obligations.

FREQUENTLY ASKED QUESTIONS

How do the tax credits work?

The Opportunity Scholarships Act provides a nonrefundable dollar-for-dollar tax credit for individuals, LLCs, S Corps, estates, and trusts. Taxpayers may claim up to 50% of their state income tax liability OR up to $100,000 (or $1M for estates and trusts).

Taxpayers will be given a proof of contribution.

For all personal financial questions, please consult your tax professional.

What if I give more than 50% of my state income tax liability.

If you give more than 50% of your 2024 liability, you can carry it over for up to 5 years. Even though the credit expires on October 31 of this year, the Dept of Revenue has stated it will honor the 5 year carryover provision (the second question on this page).

So, if you contribute $10,000 to OSN this year, but you only end up with a $18,000 state income tax liability, you can claim 50%, or $9,000, for 2024 and claim the remaining $1000 in 2025.

Why give to Opportunity Scholarships of Nebraska?

Students across the Nebraska are in need of more educational options. That’s where Opportunity Scholarships of Nebraska comes in. We are here to help kids from all areas of the state access the education that works best for them.

Contributions made through the tax credit program fund education private school scholarships for lower-income Nebraska students in Kindergarten through 12th grade.

Scholarship prioritization goes to children from the lowest-income families first, as well as students with special needs, students who experience bullying, students from military families, students in foster care, and students who are denied option enrollment are eligible for scholarships.

The program gives final priority to families making less than 300% of the federal free and reduced lunch rate.

Can my tax credit contribution benefit kids who choose my preferred school?

Yes, a contributor may give preference to up to two partner schools (or school systems) chosen by students applying for Opportunity Scholarships. Our OSN contributor portal makes it easy to apply for a tax credit contribution and select preferred schools. Visit givehope.nebraskaopportunity.org.

LB753 was sunset with the passage of LB1402. Will I still be able to claim my tax credit

Yes! According to the Nebraska Department of Revenue, donors will still be able to claim a tax credit for their contributions on their 2024 taxes as long as the credit is claimed before October 31, 2024. This includes the five-year carryover provision.

Still have questions? Please contact us at givehope@nebraskaopportunity.org.